Battle Brews as World’s Largest Coffee Exporter Eyes Imports

21 de fevereiro de 2017 19:31 BRT 22 de fevereiro de 2017 02:00 BRT

Imports are needed because of the scarcity of beans, Maggi said on Monday. He said the country lost instant coffee market share in January and February.

Congressmen from coffee-producing states organize opposition

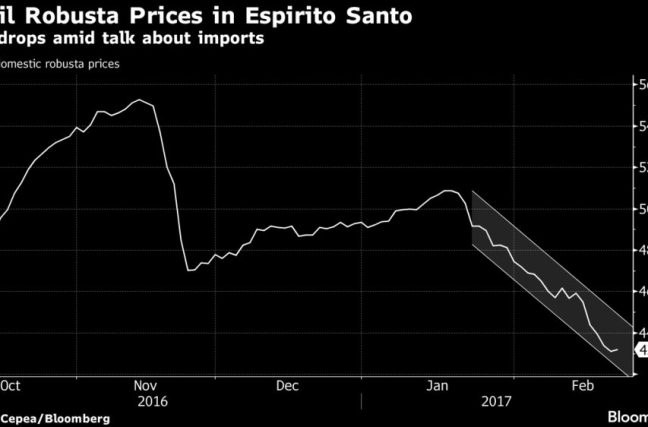

Domestic prices have plummented 22% since peaking in November

A battle is brewing in Brazil for the second time in less than a year over the government’s decision to import robusta coffee beans.

Brazil is the world’s largest producer and exporter of the commodity. However, a two-year drought has led to a collapse in output of robusta beans in Espirito Santo state, the country’s biggest grower of the variety.

Agriculture Minister Blairo Maggi said Monday the government will allow so-called green robusta imports from Vietnam, following months of lobbying from Brazilian makers of instant coffee. On Tuesday, Congressman Ricardo Ferraco, from Espirito Santo state, filed a bill in the country’s Senate to stop the move.

“If this decision is not reversed, the weight of it will fall on Brazil’s President Michel Temer,” Espirito Santo Deputy Evair Vieira de Melo said by phone. “We are mobilizing congressmen from coffee states, such as Bahia, Rondonia and Minas Gerais, to fight.”

Brazil unsuccessfully tried to import green coffee in May 2016. The government had authorized 400 metric tons of coffee from Peru and later rescinded the measure after producers protested. The issue is pitting the country’s roasters and the instant coffee industry against farmers.

Imports are needed because of the scarcity of beans, Maggi said on Monday. He said the country lost instant coffee market share in January and February.

“I respect growers, but imports are needed amid a lack of coffee in the domestic market,” Maggi said.

Plunging Prices

Domestic robusta prices have plummeted 22 percent from a record high on Nov. 14 on import talks, according to the University of Sao Paulo’s Cepea research unit. Since then, coffee farmers in Espirito Santo have lost 500 million reais ($161 million) of potential revenue because of the price decline, Melo said.

Brazil’s agriculture ministry on Monday published phytosanitary requirements to import robusta green coffee from Vietnam. It includes a 1 million-bag quota for the domestic market and unlimited amounts of green coffee imports for processing and re-exporting, a practice known as drawback, Luis Eduardo Pacifici Rangel, Brazil’s secretary for agricultural defense, said by phone.

Potential importers may be concerned that beans grown abroad could bring in pests or other phytosanitary threats into the country’s farms, Johannesburg-based trader I. & M. Smith Ltd. said in a report on Tuesday. While this could slow the pace of possible inbound purchases, once successful imports are completed, the pace could accelerate soon after, it said.

Raising Cattle

Robusta prices in London are up 54 percent in the last 12 months amid supply concerns, while arabica futures in New York have climbed 30 percent compared with a year ago.

The president of Brazil’s top robusta grower Cooabriel, Antonio Joaquim de Souza Neto, said imports would discourage robusta coffee farmers from producing the bean.

“Growers will convert their farms to produce pepper or raise cattle,” Neto said by phone. Brazil’s largest arabica-coffee cooperative Cooxupe also opposes coffee imports.

Objections from growers may succeed in blocking the imports, Marcio Candido Ferreira, director at robusta coffee trader Tristao Cia. de Comercio Exterior, said by phone from Espirito Santo state.

“I don’t think this government decision is definitive,” Ferreira said. “I see growers, politicians trying hard to intervene to stop that.

Souce: Bloomberg News