Cotações do café seguiram avançando nas bolsas, apesar de correção nesta quinta

O mercado físico brasileiro de café acompanhou as oscilações das bolsas

Notícias Recentes

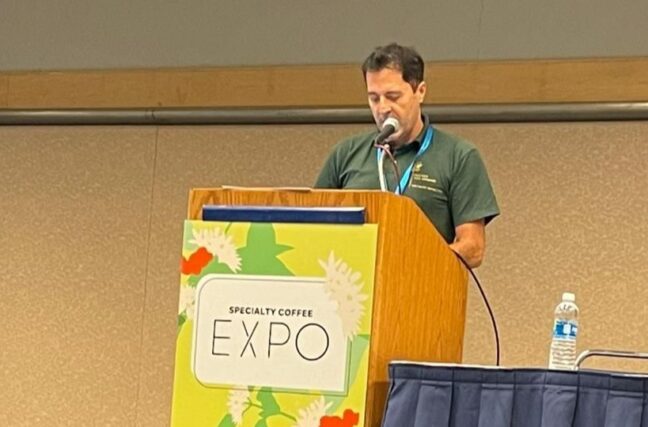

Fazenda da Região do Cerrado Mineiro é destaque no Prêmio de Sustentabilidade da Specialty Coffee Expo 2024

Prêmio de Sustentabilidade da Specialty Coffee Expo 2024 (SCA), realizada de 12 a 14 de abril, em Chicago, nos EUA.

Cotação do café arábica finaliza a sessão desta 5ª feira com baixas na Bolsa de NY

Mercado monitora safra do café no Vietnã

Produção mundial de café estimada para safra 2023-2024 totaliza 171,4 milhões de sacas de 60kg

Safra dos cafés da espécie Coffea arabica soma 97,3 milhões de sacas (56,7%) e de Coffea canephora 74,1 milhões de sacas (43,3%)

Pesquisa mostra que café é uma das bebidas que mais avança em consumo no mundo

Mais uma vez, China aparece em destaque com demanda aquecida para cafés frios e mantém janela de oportunidades

Encontro discute como melhorar industrialização do café e deixar o rótulo mais simples para o consumidor

Evento atualiza torrefadores, empresários e consumidores sobre a nova legislação que entra em vigor em junho de 2024. Palestras são gratuitas e abertas ao público; acesse o formulário de inscrição do workshop abaixo

2ª Jornada: O Mercado e o Café Carbono Neutro reúne principais nomes da cafeicultura, no Cerrado Mineiro

Evento referência no debate do tema terá sua segunda edição na cidade de Monte Carmelo, em 15 de maio

Genoma referência do café arábica é sequenciado com participação de pesquisadores brasileiros

Artigo científico publicado no último dia 15 na Nature Genetics, revista científica de alto impacto, apresenta informações inéditas em relação ao genoma e à genômica populacional dessa espécie

Conab projeta que Sul de Minas deve aumentar safra de café em 10,5% e produzir 14,9 milhões de sacas em 2024

Na região conhecida internacionalmente pelos grãos produzidos, o sucesso da safra dependerá em grande parte do manejo cuidadoso por parte dos produtores

Café Agricultor Todo Dia valoriza cafeicultores brasileiros em projeto especial com histórias inspiradoras

Projeto, promovido pela IHARA, prestigia o trabalho dos produtores rurais, que cultivam a bebida mais amada do Brasil

Robusta atinge novo recorde acima de US$ 4 mil/ton e arábica alcança 240 cents/lbp

Desde a geada em 2021 o produtor não vivenciava um mercado tão nervoso com a oferta de café